Hence 'crazy'.

I just think it's important for people to be much aware of facts before entering discussions concerning the advancement of equality. For example, when people talk about those in the top and bottom income brackets (i.e 'the rich' and 'the poor') they are often discussed as if they are different classes of people, when they are often in fact just people at different stages of their lives.

Take the following statistic - 56% of all American households will be in the top 10% at some point; usually when they're older. Furthermore, of all the people in the top 1% over the course of a decade the majority are there for just one year, and only 13% are there for two years.

There are a number of factors behind that: the fall of the Soviet Union and the rise of China, together with technological change and globalisation being the major contributors -

https://www.youtube.com/watch?v=41y4c1Oi5Uo

Much of which explains the election of Trump.

Ahh but you've left something very important out there. What was the tax revenue collected from those who fell within that bracket, and what was the proportion of the total tax take contributed by the wealthy when the rate was 70%?

Last edited by The Fly; 10/02/2020 at 10:24 PM.

https://en.wikipedia.org/wiki/Laffer_curveThe New Palgrave Dictionary of Economics reports that estimates of revenue-maximizing tax rates have varied widely, with a mid-range of around 70%.

Or we could look at what actually happened when the top marginal rate was 70%. Just an idea...The New Palgrave Dictionary of Economics reports that estimates of revenue-maximizing tax rates have varied widely, with a mid-range of around 70%.

Why are the two scales on the left and right y axis on those graphs different if they both represent the same thing. (I.e. %) I guess it proves your point in a way (maybe) but the graphs skew the information for dramatic effect.

I just think everyone should start with the basic premise that government policies influence human behaviour, and therefore that higher tax rates on individuals (and businesses) do not automatically result in higher revenues for the government. Indeed, history shows that high marginal tax rates on those in the highest earning bracket produces less revenue from said earners for the government. At a certain point, high tax rates on those with high incomes simply led to those incomes being invested in various tax-free schemes, with the revenue from them being completely lost to the government, and the investments lost to the economy.

It all depends on what the rate actually is in other words. I suppose the question that should be asked is whether people really prefer the symbolism of higher tax rates, or the substance of higher tax revenue?

All in all, I'd just prefer it if people were much more aware of facts (then the rhetoric from either side of the political spectrum wouldn't hold as much sway). The facts in this case being that part of the effect of raising taxes on the super rich is to incentivise those in that bracket to arrange their financial affairs in such a way so as to avoid paying the higher rate. Raise it too high and you incentivise them to leave.

* I take your point re: dramatic effect.

Last edited by The Fly; 11/02/2020 at 11:02 PM.

I think that the charts you linked are perhaps more symptomatic of growing inequality than capital flight, tax evasion, or disincentivisation of excellence.

The 1% are paying a greater proportion of the tax, because they are controlling a greater proportion of the income.

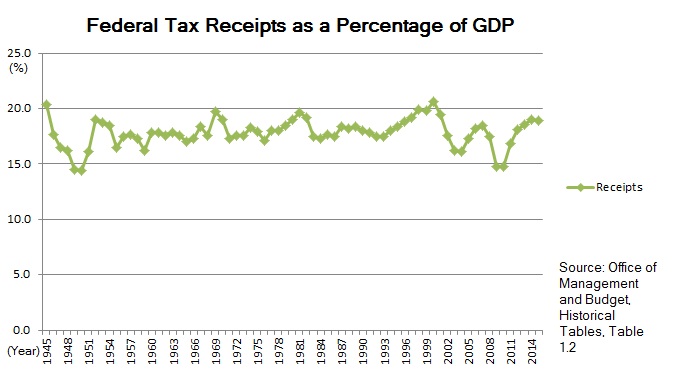

Fly, you switched from talking about the overall revenue effects of a higher upper tax rate to bringing in statistics about the proportion of taxes paid by the rich at various tax levels - two different debates. Here's the historical tax take as a percentage of GDP for the US. It would appear that the Reagan and Bush II tax cuts did lead to reductions that were not recovered as a result of a direct increase in economic activity - so it's likely that the Trump tax cuts will have a similar effect and could leave the US less able to quickly fight an economic downturn

We are not, given your posts in this thread. I don't know if you believe what you're saying or if you're just having a little fun, but I won't be conversing with you on these issues. It's not funny. It's dangerous, and I'm not engaging with it bar continuing to post facts and information in the hope that the gullible and/or uneducated won't follow your lead. You should be ashamed of your beliefs and/or actions. They are destroying society and they disgust me.

Wait a minute here. What gives you the right to try and tell me my beliefs and/or actions are disgusting and that i should be ashamed of myself or that i am doing this for a laugh? I have done next to nothing on here in bad faith and tried to enter into a dialogue with anyone who is interested - while at the same time trying to defend my opinion. I don't think i have ever said anything that warrants the above type of response. Nothing i have said is dangerous or, if it is, i would like to know what it is that meets that benchmark.

YOU engaged with ME, apparently taking umbrage with a post that says we should reserve our ire (and delight in a terminal cancer diagnosis) for those that truly deserve it. But really, if you don't want to have a conversation or enter into an honest, reciprocal dialogue then my tip would be maybe don't respond to my posts. Maybe put me on your ignore list or something if my posts cause this type of overreaction in you. Or ban me if i am all of the things you accuse me of. Otherwise, just calm down. Disagreement with one another doesn't make either of us a dangerous/disgusting/shameful individual - it should be a starting point for honest discussion not for shouting the other down.

Who's not tolerating? Everyone is entitled to their view. No-one is being stopped from posting anything within reason of back-up. If someone posts up information defending a racist, misogynistic, arrogant, egotistical, narcissistic, incompetent idiot like Trump - be prepared that people will react in kind.

"You should be ashamed of your beliefs and/or actions."

That's not very tolerant language. Saying he won't engage isn't very tolerant either, and laughable seeing as he was the one who engaged in the first place! Stu's been here a long time and has had thousands of posts on all kind of topics. I think he deserves more respect than being suspected as a wum.

Last edited by DeLorean; 13/02/2020 at 11:45 AM.

Trump is not a very tolerant president. As I said, defend him and expect to be responded to in kind.

Its a free forum and people are free to engage with whomever they like.

So if you have a certain amount of posts you can say what you like? That makes no sense.

Your post earlier reminds me of people who go on about 'snowflakes' in social media but get thick then if people reply in kind.

Yes, I'd expect to be challenged by way of a counter argument. I wouldn't expect to be told 'I should be ashamed' for having a different perspective.

It's not that free (e.g. pungate). Seriously though, dahamsta DID engage with Stu, he initiated the whole exchange, before bizarrely telling Stu 'Not everything is about him'.

I think it makes perfect sense. Your reputation is built over a period of time. Stu has been a courteous, well informed poster. There's no reason to openly suspect his motives are anything more sinister than having an alternative world view.

Has somebody got thick (other than dahamsta, I mean)?

I will engage with people who post facts and sources. I will not engage with anyone that doesn't. Neither of the pro-Trump posters in this thread post credible sources.

Honestly, they should have been banned long ago for breaking the general rule in this forum requiring sources, however I haven't done so because I don't want to be accused of bias; and, bizarrely, because no-one reports them.

My opinion is that their beliefs and/or behaviour with regard to Trump and the GOP are disgusting. It's not funny, it is dangerous. I won't engage with it. People should have learned by now that they can't be talked down. It's a waste of time and energy.

Says the guy who posts his facts from u/discoxhorse off reddit. Give me a break.

Go back over this thread and look at the sources I post when offering my thoughts and opinions. They all come from the same places others get there’s. Guess why. Because I’m in a position where I have to take care in backing up what I claim to know or information that helps form an opinion. I have to be careful it comes from a left leaning or neutral media site. Whereas others get to post from all the above plus other extremely anti-Trump sites (vox, buzzfeed, huffpost) with no questions asked. I suspect I haven’t been banned or reported because I haven’t don’t ANYTHING wrong.

As you are so fond of saying, opinions must be backed up with facts and sources. Your opinion is that I am a dangerous poster that has displayed shameful beliefs and/or actions. Your words. Your opinion. Please identify the posts where I have displayed this or issue yourself with a refraction and stern warning.

But I know you are just itching to ban me. So be my guest. You’ve done it before on here. You’ve already shown your bias and authoritarian nature. You have nothing to lose. It will probably make you feel better and help you calm down and get some perspective on all of this which is truly what the biggest issue here is cos it ain’t me.

Just on the tax discussion above. The focus above is on income tax. But there are indirect taxes too. Sales taxes / VAT, capital gains etc. The “poor” are disproportionately affected by VAT for example, yet that’s rarely discussed.

The “rich” earn a far higher share of their income from their returns on capital than from their labour; and vice versa for the poor. The poor and middle parts of the income distribution spend more of their increased disposable income from tax cuts than wealthy people do. To boost GDP this is where tax cuts should be targeted. In many developed countries marginal tax cuts to the rich have been shown to be spent on imported luxury goods, so yield no net gain to GDP. Tax cuts are generally an elegant, politically popular but difficult solution. If I was to design fiscal policy I’d look at higher spending rather than lower taxation as a fiscal boost. The adage “you know how to spend your money better than the government” is a nice soundbite but in truth I have no idea how to spend money on health, infrastructure, education or transport etc.

Trickledown economics has been discredited. Everyone can see that. And the Laffer Curve is another great seemingly intuitive soundbite but evidence shows it only holds true when the marginal tax rate is reduced from an already very high tax rate. Without appearing facetious if the Laffer Curve really was a theorem, reducing tax to zero would yield infinite tax revenue. So, as samhaydenjr alludes to above, there is a point somewhere where tax cuts help, but it’s difficult to quantify where – but it’s shown to be only at very high levels.

There’s a golden but ignored rule in economics: “Competition (as opposed to central planning) generally improves the overall welfare of society…”. This is the bit we hear all the time. Market fundamentalists harp on about it forever. But the bit they ignore is the rest which is “..as long as the winners compensate the losers”. That’s usually left out of conservative election pitches! In truth, the first part is often ignored or underplayed by left wing lobbyists.

Another fairly fundamental point is that people look at tax as a zero sum game, a simple take from Peter, give to Paul. It’s actually way more complex on a macro basis. Fiscal multipliers = a £1 of spending may actually yield more than a £1 in revenue. It depends where it’s spent and who receives it of course, just as above in discussing tax cuts. If a new building project all goes to foreign capital & labour it won’t do much. If a tax cut is saved or spent abroad it won’t do much.

Also, Classical Economics assumes for all intents and purposes a barter economy. Money and the banking system, and its capacity to create money - are believe it or not - not part of traditional classical economics. But money and banking are fundamental to the real economy. Where does money come from? It comes from (a) banks lending more than they call back from borrowers, and (b) governments running deficits. Both cause money supply to increase. Governments running surpluses takes money out of the circular flow of income, reducing money supply. If banks’ net lending falls the same happens. If both happen at the same time money supply definitely falls (ignore foreign trade here – though most of the countries we are looking at here run deficits, strengthening this point). If money supply falls without a corresponding rise in the velocity of money (i.e., the frequency at which it is spent) the effect is contractionary in the economy. It’s like taking air out of a room.

Milton Friedman (no socialist!) contended that the great depression was caused by a failure to increase money supply when it was needed. He was partly right. Keynes – who preceded Friedman – said though that relying (only) on increasing money supply to secure growth was like trying to get fat by buying a larger belt! (I love that line btw). An economy has a productive capacity – if everyone of working age makes as much as he is capable X amount of goods and services can be made. If there is not enough money to buy X (again, ignore the foreign sector for simplicity) you have unemployment. If there is more money sloshing around than is needed to buy X, you have inflation. So why is tax rel;evant here? Governments can help reduce unemploymenbt by running deficits, and can help fight inflation by running surpluses. So taxation is a generally important macro tool, not just a simple “take from Peter give to Paul” / “taxes cover spending” argument. In fact, if you think about it, spending must actually take place before taxation, not the other way around. In short, there actually IS a magic money tree.

This is why tax isn’t as simple a discussion as many made out

Bookmarks